I.C.A.R.E. Finance and Services is an empowerment program that focuses on how to relief the organization’ existing and potential clients in different areas of business.

It introduces a lot of sustainable programs such as giving out credit facilities for business investment, developing client construction work, financing of home appliances and the likes. The organization’ existing clients, community member, associations and individuals have access to all the programs, provided that they all have the capacity to fulfill their obligations with the repayment structures.

I.C.A.R.E Finance and Services department also specializes on enlightening and encouraging their clients on business developing tips and how they can boost their working capital which could have ripple effects in the society.

AREAS OF FOCUS

- CREDIT FACILITY

- PROJECT FINANCING

- ASSET FINANCING

CREDIT FACILITY

This is a program implemented by ICARE for credit disbursement for old clients who need higher credit facility, members of associations and individual who need financial support for their business expansion. ICARE set up the program for her old existing clients who have taken part in all cycles of microcredit disbursement and ready to access higher credit for their business expansion.

The credit facility attracts little and affordable charges for all clients.

Giving out credit facility is accessible provided that the client has the financial capability for the obligation and he/she is able to meet-up with the department requirement. Terms and conditions applied.

PROJECT FINANCING

The program is initiated to finance construction works, like school project, farm project, house project and so on. The program also deals with land acquisition; the parcel of land lying and situate at Shagari Estate Sagamu are available for our existing clients, individual and even members of staff who are interested. The land project attracts one payment or installment payment within a specific period of time.

The project financing scheme is set up to aid the client business plan on construction work faster, rather than the client waiting for so many years to accumulate enough savings to complete the construction project. The department helps to finance their project within a short period of time.

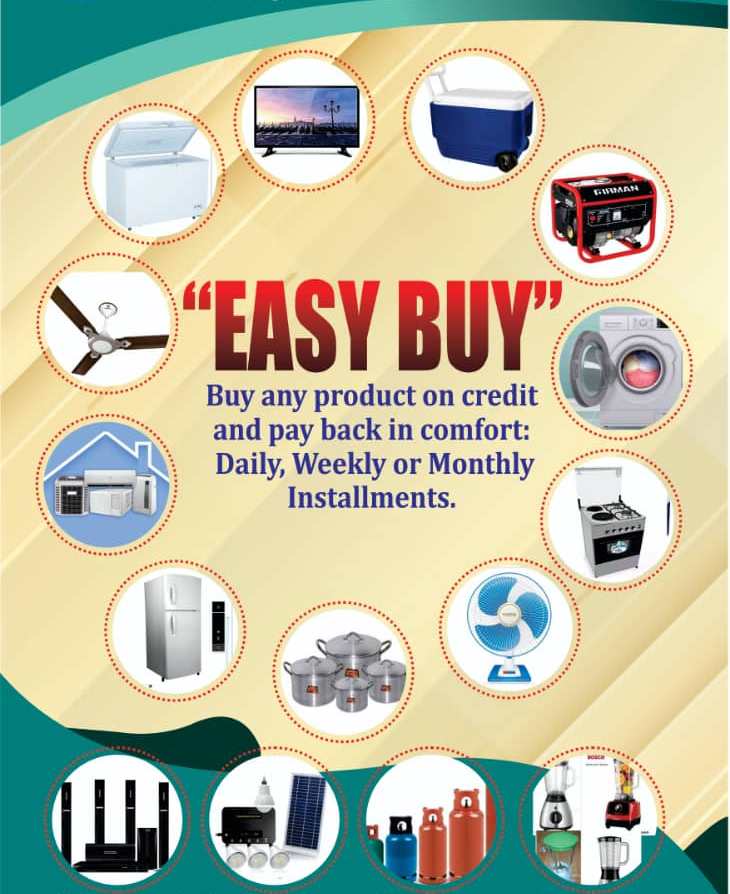

ASSET FINANCING

Asset financing deals with the financing of household appliances, such as flat screen television, home theatre, freezer, refrigerator, washing machine, air conditioner, generators, gas cooker, gas cylinders and accessories and so on.

The goods are available for existing clients and individuals who are ready to abide by the terms and conditions of the department on asset financing. The procurement of the asset gives the opportunity of installment payment and/or “cash and carry”.

09070104411, 08023083450